The Essential Guide to Summerville SC Property Taxes: Understanding and Maximizing the 4% Rule

The Essential Guide to Summerville, SC Property Taxes: Understanding and Maximizing the 4% Rule 💸🏡

Decoding South Carolina Property Tax: Why the 4% Assessment Ratio is Everything for Summerville Homeowners

When we help buyers and sellers navigate the Summerville SC real estate market, one topic generates more questions than almost any other: Property taxes. South Carolina’s system is unique, and understanding it can save homeowners thousands of dollars annually. For those moving to South Carolina from other states, the calculation, specifically the difference between the 4% and 6% assessment ratios, is a pivotal factor in determining monthly housing costs. This simple two-point difference is the key to financial security for every owner-occupied home in Dorchester, Berkeley, and Charleston counties.

The state’s tax structure is designed to heavily favor homeowners who establish their primary residence here. As a local husband-and-wife team, we’ve seen firsthand how crucial it is to get this detail right from day one. Failing to secure the correct tax classification can lead to unexpectedly high bills, tax penalties, and a lower effective home value when you eventually sell. We’re here to walk you through the specifics of the South Carolina 4% rule, ensuring you can calculate and minimize your property tax liability in Summerville.

The South Carolina Property Tax Formula Explained

To fully appreciate the power of the 4% rule, we must first understand the fundamental formula used to calculate your annual property tax bill in Summerville, SC:

Let's break down each component, with a focus on how your primary residence is uniquely treated.

1. Fair Market Value and Taxable Value (The Appraised Value)

The Fair Market Value (FMV) is essentially the value your county assessor determines your home is worth on the open market. This value is established during a county-wide reassessment, which occurs every five years across South Carolina.

A key protective feature for homeowners is the 15% Assessment Cap. After a reassessment, the Taxable Value, the value used in the tax calculation, cannot increase by more than 15% from the previous Taxable Value, unless there has been new construction or an "Assessable Transfer of Interest" (ATI), such as a sale. This cap helps shield long-term homeowners from sudden, massive tax spikes due to rapid market appreciation, a common occurrence in the growing Summerville area.

The Critical Difference: Assessment Ratios (4% vs. 6%)

This is the most critical factor for Summerville residents. South Carolina law establishes a different assessment ratio based on how the property is used. This ratio is the percentage of the home’s value that is subject to taxation.

-

The 4% Legal Residence Assessment Ratio: This reduced ratio is exclusively for owner-occupied, primary residences. When you qualify for the 4% rate, you also receive an exemption from property taxes levied for school operating purposes, which provides a massive tax break. This is the goal for every Summerville homeowner.

-

The 6% Assessment Ratio: This higher ratio is applied to all non-owner-occupied properties, including second homes, vacation properties, rental homes, and commercial properties. For investors, this higher rate is simply the cost of doing business. For primary residents who fail to apply for the 4% status, this rate results in a significantly inflated tax bill.

Millage Rate (The Tax Rate)

The Millage Rate (or millage) is the official tax rate set by local governing bodies, the county, municipality (like the Town of Summerville), school districts, and special taxing districts (like fire departments). A “mill” represents one-thousandth of a dollar ($0.001).

Local authorities determine their budget needs, divide that amount by the total assessed value of all property in their jurisdiction, and the result is the millage rate. Since Summerville crosses multiple counties (Dorchester, Berkeley, and Charleston), the millage rate will vary significantly depending on your specific address. This is why two identical homes a mile apart can have different tax bills.

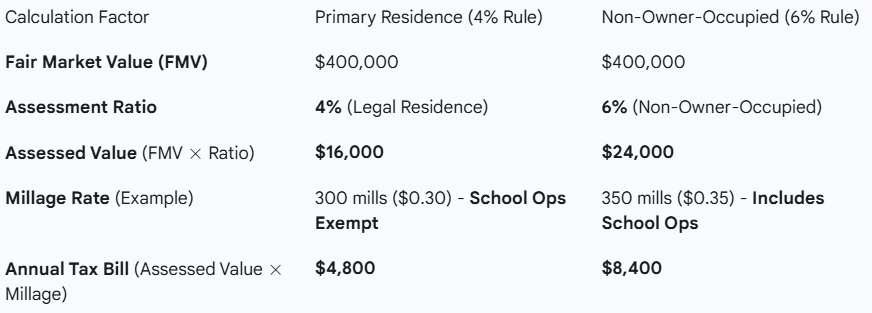

The Power of the 4% Rule: A Financial Comparison

The best way to illustrate the monumental impact of the 4% Legal Residence status is with a real-world financial example. Let's compare an owner-occupied home to a non-owner-occupied rental property with the same Fair Market Value (FMV) in a typical Summerville millage area.

In this example, securing the 4% status saves the homeowner $3,600 per year compared to the non-owner-occupied rate.

How to Qualify for the 4% Rule in Summerville: Steps for New Homeowners

Securing the 4% Legal Residence status is not automatic; you must apply for it. As your local experts, we urge you to make this your absolute top priority after closing on your Summerville home.

The Eligibility Requirements

To qualify for the 4% assessment ratio on your home and up to five acres of contiguous land, you must meet all the following criteria:

-

Ownership: You must own the property, either in full or in part, in fee simple or by life estate.

-

Occupancy & Domicile: You must actually occupy the residence as your legal residence and domicile. This means it is your permanent home—the place where you intend to return.

-

Singularity: A taxpayer (or a married couple) may only receive the 4% assessment ratio on one residence in any tax year. You cannot claim this status on two different homes, even if they are in different counties.

The Application Process

The application is filed with the County Assessor’s Office where the property is located (Dorchester, Berkeley, or Charleston). We always advise new homeowners to file in person or electronically as soon as possible after closing.

-

Obtain the Application: Access the official Legal Residence Application form from your county’s Assessor’s Office website.

-

Provide Proof of Domicile: The county will require documentation to prove the home is your permanent, legal residence. Acceptable proofs typically include:

-

South Carolina Driver's License or ID card showing the property address.

-

South Carolina Vehicle Registration showing the property address.

-

Federal Tax Returns (showing the SC address as your residence).

-

Voter Registration card.

-

Other utility bills or dated legal documents.

-

-

Meet the Deadline: The application must be filed before the first penalty date for the payment of taxes for the tax year for which you first claim eligibility (usually in January). However, we recommend filing immediately after closing to avoid any potential issues.

-

Recertification (Generally Not Required): Once approved, you typically do not need to reapply, unless the ownership, mailing address, or use of the property changes.

Essential Property Tax Exemptions for Summerville Residents

While the 4% rule provides the largest general tax break, specific groups of Summerville homeowners are eligible for even greater savings through exemptions.

The Homestead Exemption (Age/Disability)

The Homestead Exemption is a significant tax break that provides a $50,000 deduction from the fair market value of your home before calculating taxes. This exemption is available to homeowners who:

-

Are 65 years of age or older as of December 31st of the previous tax year, OR

-

Are legally blind, as certified by a licensed ophthalmologist, OR

-

Are permanently and totally disabled, as certified by a state or federal agency.

Additionally, you must have been a legal resident of South Carolina for one calendar year and hold the title to your primary residence. This exemption can drastically reduce the tax bill for qualifying Summerville seniors and disabled residents.

Other Key Exemptions

-

Totally Disabled Veterans: A 100% totally and permanently disabled veteran (or their surviving spouse) may be exempt from all property taxes on their primary residence.

-

Paraplegics and Hemiplegics: Individuals with these conditions are also eligible for special property tax exemptions.

The Summerville Property Tax Audit: What Sellers Need to Know

For sellers in Summerville, understanding property tax classification is just as important as it is for buyers. If you convert your primary residence (4% status) into a rental property or a second home (6% status) and fail to notify the county, you could face severe penalties.

The Penalty for Misclassification

The county regularly conducts audits to verify compliance with the 4% rule. If you are found to have received the 4% rate without being eligible, a penalty is imposed equal to 100% of the tax savings you received, plus interest on that amount. You will also be billed for the difference between the 4% and 6% rates for the years you were in violation (up to 10 years).

As a result, when we represent a seller who has converted their primary residence to an investment property, we strongly advise them to notify the Assessor's Office immediately. The potential penalties are far more expensive than simply paying the correct 6% rate.

Final Thoughts and Your Next Steps in Summerville Real Estate

Property taxes are an unavoidable part of homeownership, but in Summerville, SC, they are a manageable and often surprisingly low expense, thanks to the protections and exemptions provided by state law. Maximizing your investment starts with correctly applying for the 4% Legal Residence assessment ratio. This single action is the most impactful financial step a new homeowner can take.

Let Our Local Expertise Be Your Guide

Navigating county forms, deadlines, and local millage rates across Dorchester, Berkeley, and Charleston Counties can be confusing. Don't leave thousands of dollars on the table!

If you’re buying a home in Summerville, we’ll ensure the 4% application is part of your closing process. If you’re selling an investment property, we’ll help you proactively address any tax classification issues to ensure a smooth closing.

Contact us today for personalized guidance on your next real estate move. We are here to protect your financial interests and help you love living in Summerville.

Ready to understand the full cost of homeownership? Explore these other resources on our site:

-

Breaking Down Closing Costs: What to Budget for When Buying a Home in Summerville, SC

-

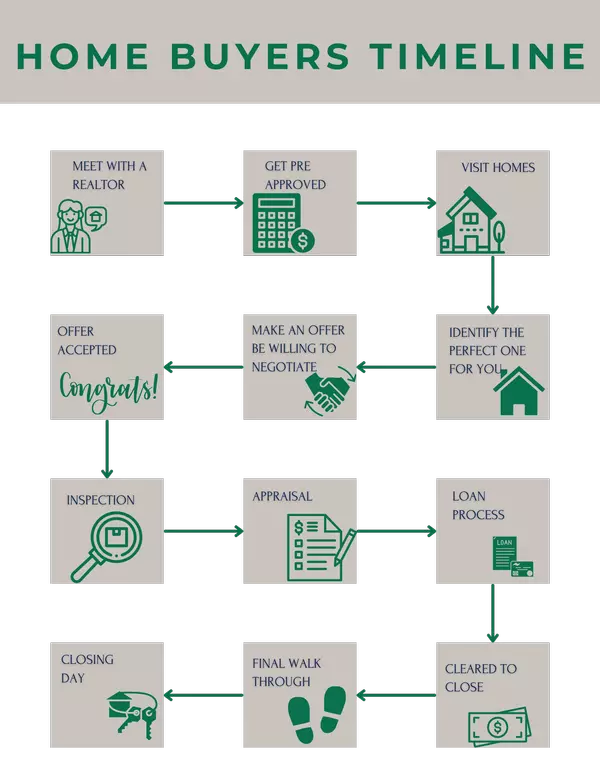

The Ultimate Guide to Mortgage Pre-Approval: Your First Step to Buying in Summerville, SC

Top 5 Property Tax Questions for Summerville Buyers and Sellers

Q1: When is the absolute deadline to apply for the 4% Legal Residence rate?

The official deadline is before the first penalty date for the payment of taxes for the year in which you claim eligibility, typically around January 15th. However, we always recommend you file the application with the County Assessor's Office immediately after closing on your Summerville home. Filing promptly ensures your status is updated in the county system well before the tax bills are generated in the fall. If you miss the initial deadline, you may have to pay the higher 6% rate for the first year and then apply for a potential refund.

Q2: Is the 4% rule permanent once our application is approved?

Yes, the 4% classification is typically permanent once approved, but only as long as you continue to use the property as your primary legal residence. You must notify the Assessor's Office within six months of any change in ownership, mailing address, or property use (e.g., converting it to a rental). Failure to report a change in use can result in the back-billing of taxes at the higher 6% rate, plus a significant penalty and interest charge.

Q3: How do the property taxes in Summerville compare to other states?

South Carolina generally boasts some of the lowest effective property tax rates in the entire United States for owner-occupied homes. This is primarily due to the 4% Legal Residence assessment ratio and the corresponding exemption from school operating taxes. While the millage rates in Summerville's counties might seem high, the low 4% assessment ratio and the school tax exemption dramatically reduce the final tax bill compared to the high assessment ratios and high rates found in many northern and western states.

Q4: If we buy a home in December, will we get the 4% rate for the whole year?

If you purchase a home in December, you are generally eligible to apply for the 4% rate for the entire tax year, provided you owned and occupied the home for some period during that tax year. The previous owner’s 4% status is typically removed at closing (due to the "Assessable Transfer of Interest" rule). You must apply for the new owner’s 4% status, and the county will then issue a corrected tax bill, usually the following year, reflecting your eligible savings.

Q5: What is the "Homestead Exemption," and is it the same as the 4% rule?

No, the Homestead Exemption and the 4% rule are two separate tax benefits, though you must qualify for the 4% rule to receive the Homestead Exemption. The 4% rule reduces the assessment ratio for all owner-occupied homes. The Homestead Exemption provides an additional $50,000 deduction from the home's value, but only for homeowners who are age 65 or older, legally blind, or totally disabled. Qualifying for both provides the maximum property tax relief available in Summerville.

Categories

- All Blogs (26)

- Cost of Living in Summerville, SC (6)

- Cost of Selling or Buying a Home (3)

- Downtown Summerville, SC (1)

- Golf in Summerville, SC (2)

- Guides (9)

- Lifestyle and Culture (3)

- Market Trends (1)

- Nearby Areas & Comparison Guides (5)

- Neighborhoods in Summerville, SC (13)

- PCSing to Summerville, SC (4)

- Property Taxes in Summerville, SC (2)

- Relocation Questions & Miscellaneous Topics (5)

- Retire in Summerville, SC (1)

- Schools in Summerville, SC (6)

Recent Posts