Our Ultimate Summerville SC Home Buyer's Guide: Your Lowcountry Dream Starts Here

Our Ultimate Summerville, SC Home Buyer's Guide: Your Lowcountry Dream Starts Here 🏡

Are you dreaming of a life surrounded by sweet tea, moss-draped live oaks, and the friendliest neighbors imaginable? Then welcome to Summerville, South Carolina, The Flowertown in the Pines! We're a husband-and-wife real estate team, and we know this market inside and out. Moving can feel daunting, but we've seen countless families successfully navigate the Summerville real estate journey. We’ve poured all of our local expertise and years of experience into this comprehensive guide. Our goal is to empower you to find your perfect Lowcountry haven. From securing a solid mortgage to finding the neighborhood that truly fits your lifestyle, this is your definitive roadmap to buying a home in Summerville.

The Lowcountry Advantage: Why Choose Summerville, SC?

Summerville offers a unique blend of historic charm and modern convenience that makes it one of the most desirable places to live in the Charleston metropolitan area. It’s a town known for its welcoming community, award-winning schools, and the lush beauty of its surrounding nature. For buyers looking for more space, a slightly lower cost of living than downtown Charleston, and a high quality of life, Summerville is a clear winner.

A Focus on Affordability and Value

While the Lowcountry housing market is competitive, Summerville real estate often presents a better value proposition compared to other areas in the Tri-County region (Berkeley, Charleston, and Dorchester counties).

-

Average Home Prices: Prices vary significantly by neighborhood, from charming historic bungalows to large new construction homes in master-planned communities.

-

Property Taxes: South Carolina is generally known for having some of the lowest property tax rates in the nation. As a homeowner of your primary residence in Dorchester County, you qualify for the favorable 4% assessment ratio, a significant saving over the 6% rate for non-owner-occupied homes.

-

Cost of Living: Many residents find that day-to-day living expenses are more manageable here, helping their housing dollar stretch further.

Unpacking the Local Real Estate Market Trends

The Summerville housing market is dynamic. Understanding local trends is key to a successful purchase. As your local experts, we analyze the data so you don't have to.

Market Indicators:

-

Median Sale Price: While this figure can fluctuate, it gives you a benchmark. We’ve observed a robust market with consistent demand, indicating a strong long-term investment.

-

Days on Market (DOM): A lower DOM often suggests a faster-paced, more competitive market where quick decisions and strong offers are crucial. Our strategy is to prepare you for speed and decisiveness.

-

Sale-to-List Price Ratio: This ratio tells us how close homes are selling to their asking price. A ratio near or above 100% means we need to be prepared for competitive bidding situations.

By monitoring these metrics, we ensure your offer is strategic and competitive, giving you the best chance to secure your dream home without overpaying.

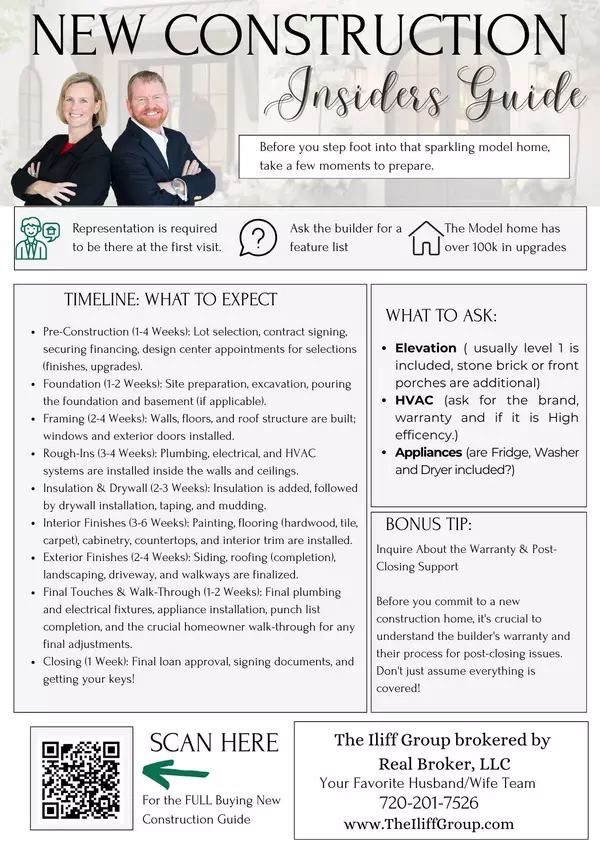

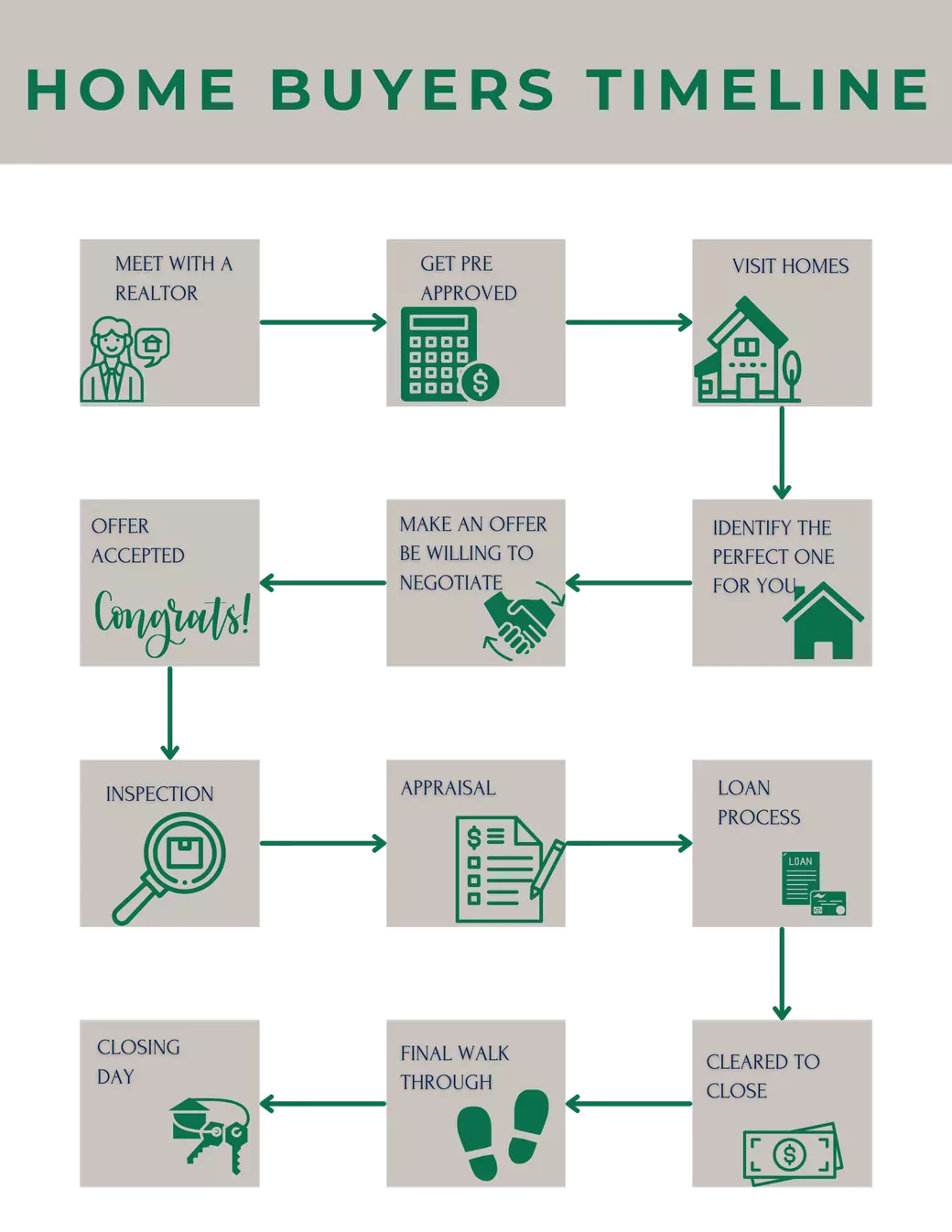

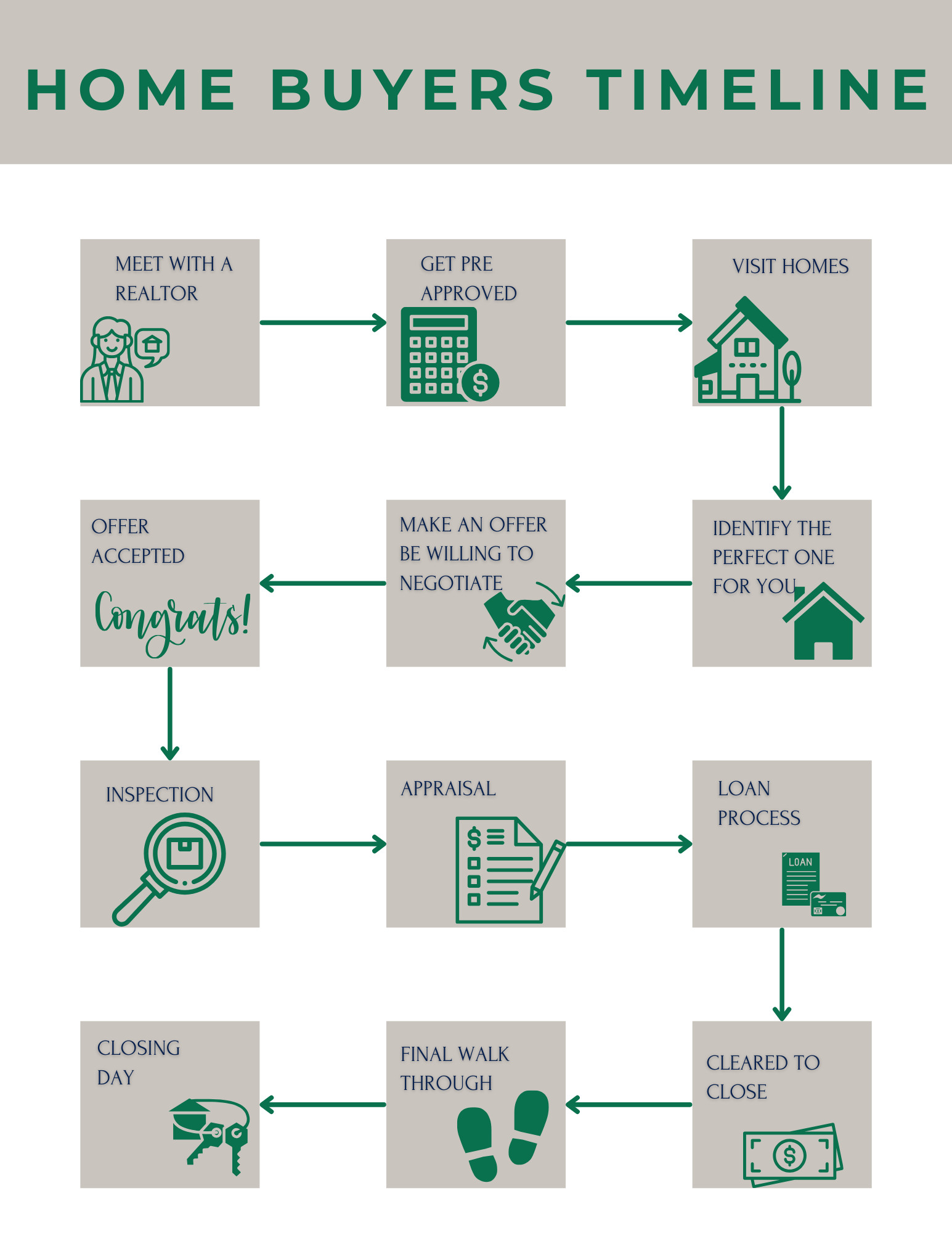

Step-by-Step: Navigating the Summerville Home-Buying Process

The journey to homeownership is exciting, and with the right guide, it can be smooth and straightforward. Here is the 10-step process we walk our clients through to buy a house in Summerville, SC.

Step 1: Getting Your Finances in Order

Before you fall in love with a home, you must know your true budget. This involves a deep dive into your savings, debts, and credit history. We recommend reviewing your credit report for accuracy and making a plan to pay down high-interest debt, as this will improve your debt-to-income (DTI) ratio.

Step 2: The Critical Step of Mortgage Pre-Approval

This is not the same as pre-qualification. Pre-approval means a lender has thoroughly reviewed your financial documents and committed to lending you a specific amount, subject to the property appraisal and inspection. In a competitive market like Summerville's, a strong pre-approval letter makes your offer much more attractive to sellers.

-

Exploring Loan Options: Many of our clients—especially first-time buyers—benefit from various loan programs:

-

Conventional Loans: Often requiring as little as 3% down.

-

FHA Loans: Government-backed with more flexible credit score requirements and a low 3.5% down payment.

-

VA Loans: Excellent zero-down options for eligible veterans and active military personnel.

-

SC Housing Programs: We help you explore local programs from the South Carolina State Housing Finance and Development Authority (SC Housing) which often provide low-fixed interest rates and Forgivable Down Payment Assistance (DPA) to help cover upfront costs.

-

Step 3: Finding Your Expert Local Real Estate Team

While we firmly believe in the value we bring, choosing the right agent is paramount. Look for a team that specializes in Summerville, demonstrates a deep understanding of local nuances, and communicates clearly. Our team offers a partnership—we combine our market knowledge with your unique needs to create a tailored home search strategy.

Step 4: Targeting the Perfect Summerville Neighborhood

Summerville is a town of distinct neighborhoods, each with its own character, amenities, and price points. Your ideal location depends on your lifestyle:

-

For Families & Amenities: Master-planned communities like Cane Bay Plantation and Nexton are extremely popular, offering extensive amenities, on-site schools, and ample green space.

-

For Historic Charm: The Historic Downtown Summerville district features beautifully maintained Victorian and Southern-style homes, walkable streets, and access to local shops and dining.

-

For Nature & Lowcountry Living: Areas like Summers Corner focus on an outdoor, nature-centric lifestyle with lakes, trails, and Lowcountry-style architecture.

-

For Value & Community: Neighborhoods like White Gables or Wescott Plantation offer a great mix of value, strong community feel, and convenience.

We take the time to tour these areas with you, helping you assess commute times, proximity to amenities, and the all-important school district boundaries.

Securing Your Investment: Offers, Inspections, and Closing

Once we've found the one, the real work begins: crafting a winning offer and navigating the contract period.

Step 5: Crafting the Winning Offer

In today's competitive landscape, your offer needs to stand out. Our strategy involves:

-

Competitive Pricing: We use comparable sales data ("comps") to advise you on a fair, yet appealing, offer price.

-

Strategic Terms: Beyond price, factors like a flexible closing date, a substantial earnest money deposit, and a strong pre-approval letter can sway a seller in your favor.

-

Contingency Management: While tempting to waive contingencies in a hot market, we always advise protecting your investment through necessary inspections and appraisals.

Step 6: The Importance of a Professional Home Inspection

Once your offer is accepted, we immediately schedule a professional, third-party home inspection. This is your chance to uncover any potential issues, from minor repairs to major structural concerns.

-

Inspection Contingency: Your contract will allow you a window of time to conduct this review. Should significant defects be found, we negotiate with the seller for repairs or a credit at closing, or we can terminate the contract if the issues are too substantial. Never skip the inspection.

Step 7: The Home Appraisal and Lending

Your mortgage lender will require a formal appraisal to ensure the home's value justifies the loan amount.

-

Protecting Your Investment: The appraiser provides an unbiased, professional opinion on the property's market value. If the appraisal comes in lower than the agreed-upon price, we have a crucial moment to renegotiate the purchase price or decide how to cover the difference.

Step 8: Finalizing the Loan and Insurance

While the appraisal is happening, your lender will finalize your mortgage. During this time, you must secure Homeowner's Insurance. Given Summerville's proximity to the coast, we also help you assess whether Flood Insurance is required or a prudent precaution, depending on the property's location.

Step 9: The Final Walkthrough

Scheduled just before closing, the final walkthrough is your last opportunity to verify that the property is in the agreed-upon condition and that any negotiated repairs have been completed. This is a critical step to avoid last-minute surprises.

Step 10: The Closing Day! 🎉

The closing is the final signing of all the paperwork, transferring ownership from the seller to you. In South Carolina, this is typically conducted by a real estate attorney. You’ll need to bring your photo ID, all necessary funds (often a certified cashier's check or wire transfer), and your enthusiasm! Congratulations, you are officially a Summerville homeowner!

Maximizing Your Investment: Schools and Community

A home is more than just four walls; it’s an investment in your family's future and your community. Summerville stands out because of its exceptional public school system.

Dorchester District Two (DD2): A Top Priority

One of the major draws for families moving to Summerville is the highly-rated Dorchester School District Two (DD2). DD2 is consistently ranked among the best districts in South Carolina.

-

Real Estate Impact: Properties zoned for the most sought-after DD2 schools often command a premium and maintain stronger resale value. Understanding school attendance lines is a key factor we discuss with all our family clients.

-

Community Connection: Excellent schools are often the bedrock of vibrant, engaged communities, contributing to the overall quality of life and stability of the area.

Life in The Flowertown in the Pines

The community spirit in Summerville is palpable. Living here means enjoying:

-

Azalea Park: A beautiful downtown centerpiece, especially famous during the annual Flowertown Festival.

-

Historic Downtown: An array of unique boutiques, local eateries, and community events like the Summerville Farmers Market.

-

Outdoor Recreation: Easy access to local lakes, rivers, and the natural beauty of the Lowcountry for boating, fishing, and hiking.

Don't Wait—Let's Begin Your Home-Buying Journey Today!

The Summerville market moves quickly, and having a dedicated, experienced team by your side is essential for success. We're committed to making your home-buying process smooth, stress-free, and successful. Don't leave your most important financial decision to chance!

Ready to find your dream home in Summerville? Contact our team today for a personalized consultation and let's start building your customized home-buying strategy. Don't miss out on your perfect Lowcountry home, we're here to help you win!

Click to explore our other valuable resources for your move to the Charleston area:

-

Our Guide to Summerville, SC Property Taxes: The 4% Rule Explained

-

Master-Planned Communities vs. Historic Homes: Which Summerville Life is Right for You?

Top 5 FAQs for Summerville Home Buyers & Sellers

1. What is the "4% Rule" for South Carolina property taxes?

The 4% assessment ratio is a significant property tax savings applied to owner-occupied, primary residences in South Carolina. Non-primary residences are assessed at a higher 6% rate, so applying for the 4% legal residence exemption immediately after closing is crucial for minimizing your annual tax bill.

2. How much money do we really need for a down payment in Summerville?

While a traditional 20% down payment helps you avoid Private Mortgage Insurance (PMI), many buyers can purchase a home with much less, often as low as 3% to 5% down using conventional or FHA loans. First-time buyers should also investigate South Carolina’s Down Payment Assistance programs, which can provide a significant boost toward covering upfront costs.

3. Is Summerville in a flood zone, and will we need flood insurance?

Summerville is a large area, and while not all properties are in designated flood zones, some parts, particularly those near rivers or low-lying areas, may be. Your lender will require flood insurance if the home is in a high-risk zone, but we strongly recommend all buyers consider it, even if not required, for added peace of mind.

4. How long does the home-buying process typically take from start to closing?

Once your offer is accepted, the contract-to-close period in South Carolina usually takes between 30 to 45 days. The length of time depends on your loan type and the speed of the inspection and appraisal processes; however, being pre-approved and responsive to document requests can significantly expedite this timeline.

5. How does the school district affect the value of a home in Summerville?

School district zoning, particularly for the highly-rated Dorchester District Two (DD2) schools, is a major factor driving home values and buyer demand in Summerville. Homes zoned for top-performing schools generally appreciate more consistently, sell faster, and retain a stronger resale value, making them a premium investment for families.

Categories

- All Blogs (83)

- Cost of Living in Summerville SC (21)

- Cost of Selling or Buying a Home (23)

- Downtown Summerville SC (6)

- Freebie (2)

- Golf in Summerville SC (2)

- Guides (15)

- Job Opportunities in Summerville SC (1)

- Lifestyle and Culture (22)

- Market Trends (3)

- Nearby Areas & Comparison Guides (15)

- Neighborhoods in Summerville SC (21)

- PCSing to Charleston - Military Guidance (12)

- PCSing to Charleston SC (22)

- Property Taxes in Summerville SC (6)

- Relocation Questions & Miscellaneous Topics (39)

- Retire in Summerville SC (5)

- Schools in Summerville SC (13)

- Things to do in Summerville SC (6)

Recent Posts