The Summerville SC Home Buying Checklist

The Summerville, SC Home Buying Checklist

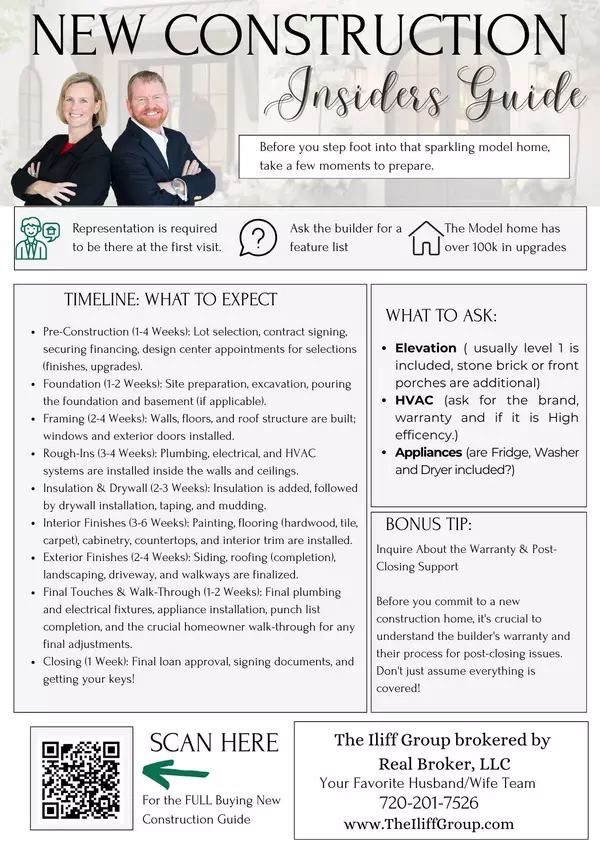

As your dedicated husband-and-wife real estate team, we know that buying a home in the Lowcountry, especially in a thriving community like Summerville, SC, is an exciting journey, but it’s one that requires careful planning. Dubbed the "Flower Town in the Pines," Summerville consistently attracts new residents with its blend of Southern charm, top-rated schools, and proximity to the Charleston metro area. However, navigating the local market is unique; it requires knowledge of everything from desirable neighborhoods like Nexton and Cane Bay to understanding the specifics of Lowcountry home features.

We’ve poured our years of experience into creating this Summerville, SC Home Buying Checklist, a comprehensive, step-by-step guide designed to demystify the process and position you for success in this competitive market. Our goal is not just to help you find a house, but to ensure you find a home that perfectly fits the coastal lifestyle you're dreaming of. Whether you’re a first-time buyer or moving from out-of-state, follow our proven roadmap to navigate the Lowcountry market with confidence.

Phase 1: Financial Foundation and Expert Partnership 🤝💸

The first step in buying a home is building a solid financial foundation and assembling your local expert team. In a fast-moving market like Summerville's, preparedness is key to making a winning offer.

1. Secure Pre-Approval from a Local Summerville Lender

This is arguably the most critical step. A pre-approval letter from a reputable, local Summerville mortgage broker or lender holds more weight with sellers than a pre-qualification from a large national bank.

-

Determine Your Budget: Don't just look at the maximum amount you're approved for. We advise clients to calculate a comfortable monthly payment that includes property taxes, homeowner's insurance (including flood, if applicable), and HOA fees.

-

Strengthen Your Offer: In neighborhoods where bidding wars are common, a strong pre-approval demonstrates that you are a serious and capable buyer, often giving you an edge over competitors.

2. Partner with a Dedicated Summerville Real Estate Team (That's Us!)

The Lowcountry market is highly nuanced, and cookie-cutter solutions simply won't work. We offer personalized attention and deep local knowledge that national platforms cannot replicate.

-

Local Market Mastery: We track hyperlocal trends, from the average sale price in Nexton to the inventory levels in Cane Bay Plantation, giving you an informational advantage. We know which areas are seeing the highest appreciation and why.

-

Negotiation Power: We are seasoned negotiators in the Summerville area, skilled at crafting compelling offers that stand out, whether you're dealing with new construction builders or established resale homes.

-

Contract Expertise: South Carolina contracts have specific legal requirements and contingencies. We ensure your contract protects your best interests at every stage, from due diligence to closing.

3. Factor in Lowcountry-Specific Homeowner Costs

Many out-of-state buyers are surprised by costs unique to our region. Budgeting for these ensures no surprises later.

-

HOA Fees: Many master-planned communities like Nexton, Cane Bay, and Carnes Crossroads have active HOAs with associated monthly or annual fees that cover amenities (pools, parks) and neighborhood maintenance.

-

Flood Insurance: Even if a property isn't in a high-risk flood zone, we often recommend flood insurance for peace of mind, as much of the Lowcountry is near water.

-

Property Taxes: South Carolina's property tax rates are generally lower than the national average, especially for primary residences (thanks to the 4% assessment ratio), but we will help you accurately estimate the annual cost for any potential property.

Phase 2: Neighborhood Selection and Home Search Strategy 🗺️🏠

Once your finances are in order, the real fun begins: determining where in Summerville you want to live and what features your Lowcountry home must have.

4. Prioritize Your Summerville Lifestyle Needs

Summerville is diverse! The community you choose will define your daily life, from your commute to your children's schools. We help you drill down on what matters most.

-

Commute Time: We'll help you map your route to major employers like Boeing, Volvo, and Joint Base Charleston, considering the local traffic patterns.

-

School Districts: Summerville's highly-regarded Dorchester School District Two (DD2) is a major draw. We provide the latest information on school boundaries, ratings, and student-teacher ratios.

-

Amenities: Do you need walking trails and a dog park (common in Nexton)? Or do you prefer a historic home closer to the charming downtown area and Hutchinson Square? We tailor our search to your specific needs.

5. Create Your Lowcountry Home Feature Wishlist

Beyond the basic number of bedrooms and bathrooms, Summerville homes often include specific features driven by the local climate and building trends.

-

Essential Features (Must-Haves): For example, a screened porch or covered patio is essential for enjoying the mild Lowcountry evenings without dealing with bugs. A dedicated home office space is now a top priority for many.

-

Climate Considerations: We look for homes with energy-efficient HVAC systems, good insulation, and elevated foundations to mitigate moisture and energy costs, which are crucial in our climate.

-

Flex Space: Homes in Summerville often feature "FROG" (Finished Room Over Garage) or a "Flex Room." We help you envision how this space can serve as a home gym, media room, or guest suite.

6. Master the Summerville Neighborhood Landscape

Understanding the distinct personalities of Summerville's top areas will narrow your search efficiently.

-

Nexton: Known for its cutting-edge, tech-forward living, Gigabit internet, and a vibrant mixed-use town center (Nexton Square). It appeals to young professionals and families seeking a modern, amenity-rich environment.

-

Cane Bay Plantation: A sprawling, highly sought-after community offering diverse housing options, numerous amenities, and dedicated golf cart paths. It provides a true "community within a community" feel.

-

Historic Summerville: Features classic Southern architecture, mature landscaping, and walkable access to the unique boutiques and restaurants of downtown. Perfect for those who value charm and history.

Phase 3: Making the Offer and Closing the Deal 🔑🎉

Once you've found the perfect home, the final phases are all about strategy, due diligence, and preparing for your new life in the Lowcountry.

7. Crafting a Competitive Offer Strategy

In a competitive market, an offer is about more than just price. We use our local knowledge to structure a deal the seller can’t refuse.

-

Escalation Clauses: In bidding situations, we can strategically use an escalation clause, where your offer automatically increases up to a maximum amount to beat competing bids.

-

Due Diligence Fee: In South Carolina, the Due Diligence period is critical. We advise on the appropriate, non-refundable Due Diligence Fee to show serious intent, which is a powerful negotiating tool for sellers.

-

Flexible Closing Dates: If possible, offering a closing date that suits the seller's needs (especially if they are purchasing a new construction home) can make your offer highly attractive.

8. The Crucial Lowcountry Due Diligence Period

The Due Diligence period is your chance to fully investigate the property. We connect you with trusted, local professionals for thorough inspections.

-

Home Inspection: Beyond standard checks, we prioritize inspections for common Lowcountry issues: moisture intrusion, termite/pest activity, and the condition of the crawl space.

-

WDO (Wood Destroying Organism) Inspection: Standard in our area, this ensures the home is free from active termite damage or other wood-destroying pests.

-

Sewer Scope: Recommended for older homes, this inspects the sewer line for blockages or damage that could lead to costly issues later.

9. Finalizing Financing and Insurance

Your lender and insurance agent finalize their work during this period, ensuring a smooth transition to ownership.

-

Appraisal: The lender requires an appraisal to confirm the home's value justifies the loan amount. We keep a close eye on this, especially if the sales price exceeds the listing price.

-

Homeowner’s Insurance: Securing insurance that covers wind, hail, and, if needed, flood insurance is mandatory before closing. We work with local agents who understand the specific needs of coastal properties.

10. The Final Walk-Through and Closing Table

The day before closing, we conduct a final walk-through to ensure the property is in the agreed-upon condition. Then, it's time to sign!

-

Review All Documents: We review the final Closing Disclosure with you to ensure all credits, costs, and fees are accurate and match the contract terms.

-

Sign and Celebrate: At the closing attorney's office, you'll sign the final documents. Congratulations! You are officially a homeowner in the beautiful "Flower Town in the Pines."

📞 Your Summerville Homeownership Journey Starts Here!

The Summerville, SC Home Buying Checklist is your comprehensive guide, but a checklist is just the beginning. The competitive and unique Lowcountry market demands personalized expertise. As your trusted husband-and-wife team, we've helped hundreds of clients successfully navigate these waters, turning their Summerville home dreams into reality. We handle the complexities so you can focus on packing your bags and planning your first visit to Hutchinson Square.

Ready to find your perfect home in the "Flower Town in the Pines"? Don’t miss out on your ideal property in Nexton, Cane Bay, or Historic Summerville.

Contact us today to schedule your personalized Summerville home-buying consultation! We’ll put our local market mastery to work for you.

Related Resources:

Let us guide you to your new front porch in Summerville!

Frequently Asked Questions

1. What are the average property taxes for a primary residence in Summerville?

Property taxes in Summerville, SC, are determined by the property's assessed value and local millage rate, but the homeowner exemption significantly reduces the tax burden. For a primary residence, the home is assessed at 4% of its market value, leading to a much lower effective tax rate than many other states. We can calculate a precise estimate for any property you're considering, helping you budget accurately for your total monthly housing cost. Overall, Lowcountry property taxes are a significant advantage for homeowners here.

2. How long does the home buying process typically take in the Summerville market?

The typical home buying process in Summerville, from the initial offer acceptance to closing, takes approximately 30 to 45 days, though new construction can take 6–12 months. This timeframe includes the critical Due Diligence period (usually 7-14 days for inspections) and the time needed for the lender to complete the appraisal and underwriting process. We work diligently to keep your timeline on track by using local lenders and inspectors who are familiar with the area. We always aim for a smooth, efficient closing that meets your scheduling needs.

3. Are there significant HOA fees in the most popular Summerville neighborhoods?

Yes, the most popular, master-planned Summerville neighborhoods like Nexton and Cane Bay Plantation typically have Homeowners Association (HOA) fees that are either paid monthly or annually. These fees can range from low to moderate and are mandatory, covering the costs for community amenities such as pools, clubhouses, common area maintenance, and sometimes specific services. We ensure you review all HOA documents and fee structures before making an offer so you fully understand your ongoing financial commitment. These fees contribute to maintaining the high quality of life residents enjoy.

4. What are the biggest risks or issues found during home inspections in the Summerville area?

The biggest issues found during Summerville home inspections are often related to the local climate and humidity. We prioritize looking for moisture intrusion in crawl spaces and attics, which can lead to wood rot or mold, and we always perform a WDO (Wood Destroying Organism) inspection for termites. HVAC system performance is also critical, given our long, hot summers, so we ensure the unit is appropriately sized and well-maintained. We guide you through any inspection findings to negotiate repairs or necessary credits.

5. Is it a good time to buy a home in Summerville, or is the market too competitive?

Despite national economic fluctuations, the Summerville market remains highly attractive due to the influx of major employers and the highly-rated DD2 school district, indicating long-term growth and stability. While competition exists, especially for well-priced homes in key neighborhoods, we develop a proactive, strategic approach to help your offer stand out. We believe that with the right planning, a strong local real estate team, and a pre-approval in hand, now is a great time to invest in your future and secure a home in this thriving Lowcountry community.

Categories

- All Blogs (83)

- Cost of Living in Summerville SC (21)

- Cost of Selling or Buying a Home (23)

- Downtown Summerville SC (6)

- Freebie (2)

- Golf in Summerville SC (2)

- Guides (15)

- Job Opportunities in Summerville SC (1)

- Lifestyle and Culture (22)

- Market Trends (3)

- Nearby Areas & Comparison Guides (15)

- Neighborhoods in Summerville SC (21)

- PCSing to Charleston - Military Guidance (12)

- PCSing to Charleston SC (22)

- Property Taxes in Summerville SC (6)

- Relocation Questions & Miscellaneous Topics (39)

- Retire in Summerville SC (5)

- Schools in Summerville SC (13)

- Things to do in Summerville SC (6)

Recent Posts