Breaking Down Closing Costs: What to Budget for When Buying a Home in Summerville SC

Decoding Summerville, SC Home Buyer Closing Costs: Our Essential Budgeting Guide

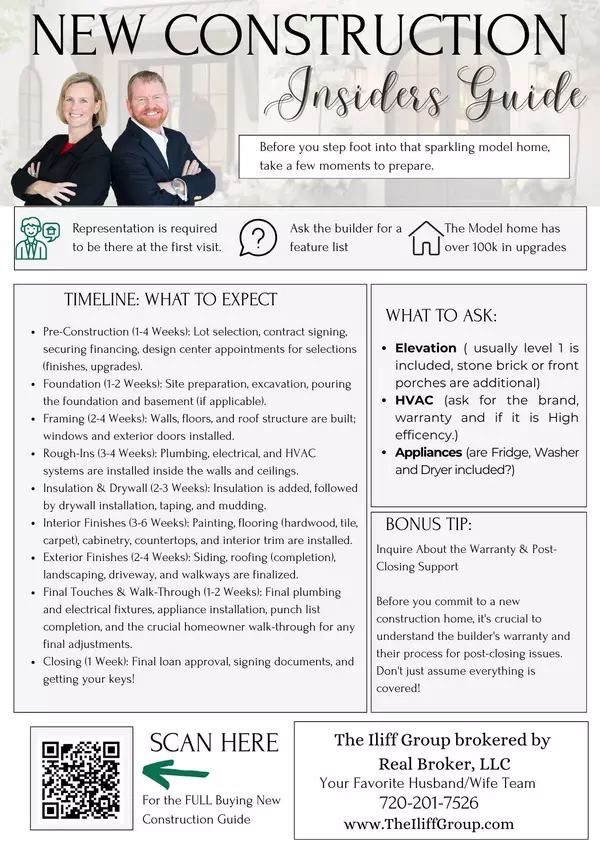

Buying a home in Summerville, South Carolina, is an exciting journey, and we are thrilled to be your guides. As your local husband-and-wife real estate team, we’ve helped countless families navigate the path to homeownership in this beautiful area. One of the most critical steps in this process is understanding and budgeting for closing costs. These are the necessary fees and expenses, separate from your down payment, that finalize the real estate transaction. Without a clear picture, these costs can catch a buyer off guard, which is why we’ve created this comprehensive guide to help you budget accurately for your Summerville home purchase and step into closing day with confidence.

Why Closing Costs Matter: Setting the Stage for Financial Clarity

The excitement of negotiating a purchase price and finalizing a mortgage often overshadows the line items detailed on your Closing Disclosure. However, closing costs are a non-negotiable part of the process, typically ranging from 2% to 5% of the home’s purchase price in South Carolina. For a Summerville home, this could mean thousands of dollars, making proactive budgeting essential. We always tell our clients: know the numbers upfront, and there will be no surprises at the closing table. Our local knowledge of the Dorchester and Berkeley County markets gives us a unique perspective on what to expect for our buyers.

The Three Pillars of Buyer Closing Costs in Summerville

Buyer closing costs generally fall into three primary categories: Lender Fees, Title & Legal Fees, and Prepaids & Escrows. Understanding what each category covers is the key to effective budgeting.

Pillar 1: Lender and Loan Origination Fees

These are costs associated with securing your mortgage financing. They compensate the lender for their services and are generally non-negotiable once you commit to a lender, although you can shop around before that commitment.

-

Loan Origination Fee: This is the charge by the lender for processing, underwriting, and administering the loan. It typically amounts to about 0.5% to 1% of the loan amount.

-

Appraisal Fee: A mandatory fee paid to a professional appraiser to determine the fair market value of the property. Lenders require this to ensure the home is worth the amount they are lending. In our area, this often runs from $400 to $600.

-

Credit Report Fee: A small fee to pull your credit report, which the lender uses to determine your eligibility and interest rate.

-

Underwriting Fee: This covers the lender’s cost to evaluate and approve your loan application. It is sometimes bundled with the origination fee.

-

Discount Points (Optional): If you choose to "buy down" your interest rate, you will pay discount points. One point equals 1% of the loan amount and typically lowers your rate. This is an upfront cost for a long-term saving, and we can help you determine if it makes financial sense.

Pillar 2: Title, Legal, and Brokerage Fees (The Buyer’s Team)

This critical category includes fees for the legal professionals and the real estate experts who ensure the transaction is sound and compliant.

-

Real Estate Brokerage Fee (Buyer Agent Commission): Historically, the seller paid all agent commissions, but current practices mean buyers are now responsible for compensating their own agent. This fee is always negotiable and averages between 2.5% and 3.0% of the purchase price in the Summerville area. It is crucial to budget for unless we successfully negotiate the seller to cover it via a concession. We establish this compensation directly with you in our Buyer Agency Agreement.

-

Attorney Fees (Required in SC): South Carolina law mandates a licensed attorney conduct the closing. This fee covers their time to oversee the process, prepare documents, and ensure legal compliance. In Summerville, attorney fees for a closing often range from $1,000 to $2,000, which frequently includes the title services. Always ask for an itemized quote.

-

Title Search Fee: The attorney performs a thorough search of public records to confirm the seller is the legal owner and that there are no hidden claims, liens, or easements against the property’s title. This is essential to guarantee a clear transfer of ownership.

-

Lender's Title Insurance: This mandatory policy protects the lender’s investment against any future title disputes. The cost is regulated and based on the loan amount.

-

Owner's Title Insurance (Highly Recommended): This is a one-time fee paid at closing that protects you, the homeowner, for as long as you own the property. While not required, we strongly advise this policy to cover claims like forgery or errors in public records. The cost generally falls between 0.5% to 1.0% of the sale price.

-

Recording Fees: Charged by Dorchester or Berkeley County (or whichever county your Summerville home is in) to officially record the new deed and mortgage in public records. These are typically smaller, fixed fees.

-

Survey Fee (If Required): Your lender may require a land survey to confirm property boundaries, which can cost several hundred dollars.

Pillar 3: Prepaids and Escrow Items

These are not fees for services, but rather payments for expenses related to your new home that must be paid at closing to cover the time between closing and your first mortgage payment, or to fund your future escrow account.

-

Prepaid Homeowners Insurance: Lenders typically require you to pay a full year's worth of your homeowner's insurance premium upfront at closing. This ensures the property is protected immediately.

-

Prepaid Property Taxes (Prorated): You will prepay your portion of property taxes from the closing date through the end of the month, or possibly longer, depending on how local taxes are calculated and the closing date. Since South Carolina property taxes are paid in arrears, this proration ensures taxes are current.

-

Prepaid Interest (Per Diem Interest): This covers the mortgage interest that accrues from the closing day up to the first day of the following month. The earlier in the month you close, the higher this amount will be.

-

Initial Escrow Deposit: If your lender requires an escrow account (which is common, especially with less than a 20% down payment), you will deposit funds to cover future property taxes and homeowner’s insurance payments. This is often an amount equivalent to a few months' worth of taxes and insurance payments held in reserve.

Navigating Local Summerville, SC Specific Costs

While many costs are standardized across South Carolina, a few local nuances affect your budget:

Property Transfer Tax (Deed Recording Fee)

In South Carolina, the real estate transfer tax is officially called the Deed Recording Fee. The rate is $1.85 per $500 of the property's value. While it is customary for the seller to pay this fee, it is technically negotiable. As your agents, we ensure this is addressed clearly in the purchase agreement. Even if the buyer doesn't pay it directly, the cost can influence the overall negotiation.

Home Inspection and Repairs

Though technically pre-closing costs, the home inspection and potential repairs significantly impact your total cash needed.

-

Home Inspection Fee: Highly recommended and usually costs $300 to $600 locally. This is paid directly to the inspector before closing. A professional inspection is a small price to pay for peace of mind.

-

Termite/CL-100 Inspection: A Wood Infestation Report (CL-100) is often required by lenders, or at least strongly encouraged, to certify the property is free from wood-destroying insects. This is a separate fee paid to a licensed professional.

-

Repair Costs/Credits: If the inspection uncovers issues, we will negotiate with the seller. Any agreed-upon costs are either paid by the seller, or the buyer receives a Seller Concession (a credit toward closing costs) to cover the expense.

Strategies to Reduce and Budget for Closing Costs

Don't panic about the final numbers! As your dedicated team, we utilize several strategies to help you minimize these out-of-pocket expenses:

-

Negotiate Seller Concessions (Closing Cost Credit): This is our most powerful tool. We can negotiate with the seller to pay a portion of your closing costs. The amount they can contribute is regulated by your loan type (e.g., Conventional, FHA, VA). This effectively reduces the cash you need to bring to the closing table.

-

Shop for Third-Party Services: While your lender's fees are fixed, you have the right to shop around for certain third-party services like homeowners insurance and the closing attorney/title company. We work with a network of trusted local professionals who offer excellent service and competitive rates.

-

Compare Lenders: Different lenders charge different origination and processing fees. Comparing Loan Estimates from multiple lenders is crucial for finding the best overall deal.

-

Analyze Your Prepaids: The closing date can affect your prepaid interest and prorated taxes. If cash flow is critical, closing later in the month might slightly reduce your prepaid interest expense.

Our Commitment to Transparent Homebuying in Summerville

We believe that knowledge is your most valuable asset when buying a home. By providing you with this detailed breakdown of Summerville closing costs, we ensure you can budget wisely and focus on the excitement of moving into your new Lowcountry home. We are here to demystify every line item on your Closing Disclosure and advocate for you every step of the way, aiming to make your closing day a celebration, not a financial surprise.

Ready to find your perfect Summerville home and navigate the closing process with expert guidance?

Contact us here.

Learn more about buying in Summerville SC: Your Guide to Mortgage Pre-Approval, Your Essential First Step to Buying in Summerville SC

Top 5 Closing Cost Questions for Summerville Home Buyers

1. How much cash do we need for closing costs in Summerville, SC?

Closing costs for buyers in Summerville typically range from 2% to 5% of the purchase price, not including the down payment. The exact amount depends on your loan type, the price of the home, and the specific fees charged by your lender and chosen service providers. We estimate an average buyer should budget between $4,000 and $8,000 or more on top of their down payment for a median-priced home. Your final, detailed amount will be provided on the official Closing Disclosure form you receive before closing.

2. Is title insurance mandatory in South Carolina, and what does it cover?

Lender's Title Insurance is mandatory in South Carolina to protect the mortgage lender’s financial investment against title defects. Owner's Title Insurance, which protects you, the homeowner, is optional but highly recommended; it is a one-time fee lasting the duration of your ownership. It covers costs and losses resulting from challenges to your property ownership, such as forged documents, errors in past deeds, or undisclosed heirs.

3. As buyers, can we negotiate to have the seller pay our closing costs?

Yes, absolutely! We can negotiate for the seller to provide a "Seller Concession," which is a credit toward your closing costs. The maximum amount the seller can contribute is governed by your specific loan type and the size of your down payment. Utilizing this concession is a very common strategy in Summerville to reduce your out-of-pocket expenses at closing.

4. Why are South Carolina closing costs higher due to attorney fees?

South Carolina is one of a handful of states that legally requires a licensed attorney to conduct the real estate closing and supervise the signing of all legal documents. This legal requirement adds an attorney fee to your closing costs, which covers the professional legal oversight, title search, and preparation of documents. While adding to the expense, this requirement provides a high level of legal protection for both buyers and lenders.

5. What are “prepaid items” at closing, and why do we have to pay them?

Prepaid items are expenses related to homeownership that must be paid in advance at closing to ensure your new home is protected and fiscally current from day one. These typically include the first year's homeowners insurance premium, prorated property taxes from the date of closing, and prepaid mortgage interest up to your first payment date. Additionally, you may pay an initial deposit into an escrow account to cover future tax and insurance bills.

Categories

- All Blogs (83)

- Cost of Living in Summerville SC (21)

- Cost of Selling or Buying a Home (23)

- Downtown Summerville SC (6)

- Freebie (2)

- Golf in Summerville SC (2)

- Guides (15)

- Job Opportunities in Summerville SC (1)

- Lifestyle and Culture (22)

- Market Trends (3)

- Nearby Areas & Comparison Guides (15)

- Neighborhoods in Summerville SC (21)

- PCSing to Charleston - Military Guidance (12)

- PCSing to Charleston SC (22)

- Property Taxes in Summerville SC (6)

- Relocation Questions & Miscellaneous Topics (39)

- Retire in Summerville SC (5)

- Schools in Summerville SC (13)

- Things to do in Summerville SC (6)

Recent Posts