The Ultimate Guide for First-Time Homebuyers in Summerville SC: Your Path to Homeownership

The Ultimate Guide for First-Time Homebuyers in Summerville, SC: Your Path to Homeownership

Welcome to Summerville, South Carolina! If you're a first-time homebuyer, you've chosen a fantastic place to plant your roots. Known as "Flowertown in the Pines" for its beautiful azaleas and sweet tea-sipping porches, Summerville offers a unique blend of small-town charm, top-tier schools (especially in Dorchester District Two), and easy access to the entire Lowcountry region.

As a dedicated husband and wife real estate team, we understand that buying your first home can feel overwhelming. We've compiled this ultimate, comprehensive guide to demystify the process and help you confidently navigate the Summerville market. Our goal is to equip you with the knowledge to make a winning offer and find the perfect home in this thriving South Carolina town.

Phase 1: Financial Readiness & The Power of Pre-Approval

The foundation of a successful first home purchase is a rock-solid financial plan. Before you fall in love with a property, you must know exactly what you can afford and how you'll pay for it.

Determining Your True Budget and Savings Goals

Many first-time buyers focus only on the down payment, but we need to look at the whole picture.

-

Down Payment: While 20% is the ideal to avoid Private Mortgage Insurance (PMI), many government-backed loans (FHA, VA, USDA) and state programs allow for much less, often as low as 3.5% or even 0%.

-

Closing Costs: This is the surprise for many. In South Carolina, buyer closing costs typically range from 2% to 5% of the purchase price. This includes lender fees, appraisal, title insurance, pre-paid property taxes, and attorney fees (required in SC). For a $350,000 home, this could be $7,000 to $17,500 in addition to your down payment.

-

The Debt-to-Income (DTI) Ratio: Lenders scrutinize your DTI, the percentage of your gross monthly income that goes toward paying debts (car payments, credit cards, student loans). Keeping your DTI below 43% is generally the goal for loan qualification. We encourage paying down high-interest debt first.

-

Cash Reserves: Lenders often like to see that you have two to three months of mortgage payments saved after closing. This proves financial stability.

The Non-Negotiable Step: Mortgage Pre-Approval

Prequalification is a rough estimate; pre-approval is a commitment, and it's essential in the competitive Summerville market.

-

What it Is: Pre-approval means a lender has formally reviewed your credit, income, and assets and has committed in writing to lend you a specific amount, subject to the property appraisal.

-

Why It Matters in Summerville: In multiple-offer situations, sellers and their agents will always prioritize an offer with a strong pre-approval letter from a reputable local lender. It proves you are a serious, qualified buyer.

-

The Timeline: Once you submit the required paperwork (W-2s, pay stubs, bank statements, tax returns), a lender can often issue a pre-approval letter within 24 to 48 hours. This should be done before you start house hunting.

Leveraging South Carolina First-Time Homebuyer Programs

South Carolina offers tremendous resources to minimize the upfront costs of buying your first home.

-

SC Housing Programs: The state offers programs like the SC Housing Homebuyer Program and Palmetto Home Advantage. These typically provide low, fixed-interest rate 30-year mortgages and can be coupled with Forgivable Down Payment Assistance (DPA) loans.

-

DPA Details: The DPA is often a second mortgage with 0% interest and no monthly payments, forgiven entirely after a set number of years (e.g., 10 or 15 years) of ownership. This can cover a significant portion of your down payment and closing costs.

-

-

Mortgage Credit Certificate (MCC): This program allows qualified first-time buyers to claim a federal tax credit of up to $2,000 annually for the life of the loan. This is a dollar-for-dollar reduction in your tax liability, increasing your net take-home pay and monthly affordability.

-

Our Guidance: We work hand-in-hand with our preferred local lenders who specialize in these programs to see if you qualify. It’s a key advantage for first-time buyers.

Phase 2: Finding Your Place in Flowertown

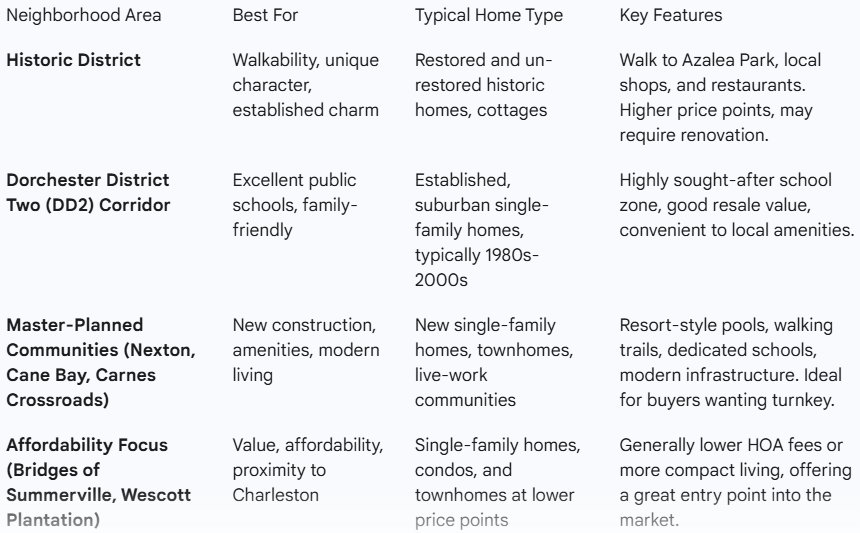

Summerville offers a diverse real estate landscape, from charming historic properties near the downtown to sprawling master-planned communities. Choosing the right neighborhood is as important as choosing the right house.

Top Summerville Neighborhoods for First-Time Buyers

Your ideal neighborhood depends on your lifestyle, budget, and commute.

The Must-Have Home Checklist and Showing Strategy

Before we start showing homes, we will help you create a detailed list of non-negotiable features versus desirable wants.

-

Commute Time: Summerville’s central location means easy access to Charleston, North Charleston, and the I-26 corridor, but traffic can be a factor. We will map your commute times at peak hours.

-

HOA Fees and Restrictions: Many modern communities have Homeowners Association (HOA) fees. These cover amenities and common area maintenance. We will ensure you are comfortable with both the cost and the community rules before we make an offer.

-

What We Look For: As your agents, we look past the aesthetics. We assess the age and condition of the roof, the HVAC system, the water heater, and the foundation. These are the major-cost items that first-time buyers must anticipate.

Photo credit: Carnes Crossroads.com

Photo credit: Carnes Crossroads.com

Phase 3: Making the Winning Offer and Navigating Inspection

In the Lowcountry, the buying process moves quickly. A well-constructed offer, backed by a strong pre-approval, is your best tool.

Crafting the Strategic Offer

We will conduct a detailed comparative market analysis (CMA) to determine the home's fair market value. The offer price is only one component of a successful bid.

-

Contingencies: These protect you. Common contingencies include the financing contingency (if you can't get the loan, you get your earnest money back) and the inspection contingency. In a competitive market, sometimes buyers reduce these contingencies, but we will advise you on the risk involved.

-

Earnest Money Deposit (EMD): This is a good faith deposit, typically 1% of the purchase price, that is held in escrow. It shows the seller you are serious. If the deal closes, the EMD is applied to your closing costs. If you back out without a valid contingency, the seller keeps it.

-

Seller Concessions: We can negotiate for the seller to pay a portion of your closing costs. In SC, the maximum a seller can contribute depends on the loan type (e.g., 3-6% for FHA, 3-9% for Conventional). This is a crucial strategy for first-time buyers to limit their cash-to-close.

The Crucial Role of Home Inspection

Once your offer is accepted, the due diligence period begins, and the home inspection is the most important part.

-

The SC Inspection Difference: We always recommend hiring a licensed inspector who is intimately familiar with Lowcountry construction. They know to look for signs of wood-destroying insects (termites are common), moisture intrusion in the crawlspace, and issues with the clay soil.

-

Negotiating Repairs: The inspection provides you with leverage. We will help you prioritize major health, safety, and structural issues. We don't ask for cosmetic repairs, but we fight to ensure the big-ticket items, HVAC, roof, foundation, are in good order or that the seller contributes money toward their repair.

Phase 4: From Contract to Keys (The Closing Process)

South Carolina is an "attorney state," meaning an attorney must conduct the closing. This is the final sprint toward homeownership.

Appraisal and Final Underwriting

Once the inspection is resolved, your lender orders the appraisal to confirm the home's value justifies the loan amount.

-

The Appraisal Gap: If the appraisal comes in lower than the contract price, we have three options: renegotiate the price with the seller, you bring the difference in cash, or we challenge the appraisal. We will strategize the best approach based on the market.

-

Underwriting: This is the lender's final deep dive into your finances. It’s crucial that you do not make any major purchases (no new cars, furniture on credit, or new credit cards) and do not change jobs during this period, as it can jeopardize your loan approval.

The Final Walkthrough and Closing Day

The day before closing, we will do a final walkthrough to ensure all agreed-upon repairs have been completed and the home is in the same condition as when you signed the contract.

-

Closing Day: You will meet at the attorney’s office to sign the mountain of final paperwork. You will need a cashier’s check or a wire transfer for your remaining down payment and closing costs. Once the final documents are signed, the funds are disbursed, and the keys are officially ours! You are now a Summerville homeowner!

Your First Year: Settling into Summerville Life

Congratulations! You’ve navigated the process and own a home in Flowertown. Now the adventure of homeownership begins.

Homeowner Essentials in the Lowcountry

-

Pest Control: Regular, preventative pest control is essential in the Lowcountry climate. Termites, ants, and other insects are a constant concern.

-

Insurance: We remind first-time buyers that flood insurance may be required, depending on the property's zone. Even if not required, a good homeowners policy is a must-have protection.

-

Property Taxes: Dorchester County property taxes are paid in arrears, meaning you pay for the previous year. We'll make sure you understand the tax schedule and how your mortgage escrow accounts manage this expense.

We are here for you long after the closing day. Whether you need a referral for a reliable plumber or advice on your first property tax bill, our team remains your trusted real estate resource in Summerville.

Ready to start your journey to homeownership in Summerville? Stop scrolling through listings and start the pre-approval process that puts you in a position to win. We don't just open doors; we educate, advocate, and negotiate for you every step of the way. Let us put the keys to your first Summerville home in your hands!

Contact Us Today!

Top 5 Questions About Buying or Selling a Home in Summerville, SC

1. How much cash do we truly need to have saved for a $350,000 home?

-

Question: We are looking at homes around $350,000; what is the realistic minimum cash we need to close, including the down payment and other fees?

-

Answer: For a $350,000 home using a low-down-payment program (like FHA at 3.5%), you would need $12,250 for the down payment alone. Add 3% to 5% for closing costs (another $10,500 to $17,500), totaling at least $22,750 to $29,750. However, if we successfully negotiate seller concessions or utilize a Down Payment Assistance program, we can significantly reduce this cash-to-close amount.

2. Which school district is most important for resale value in Summerville?

-

Question: If we don't have children yet, which Summerville school district should we prioritize to ensure the best long-term resale value for our first home?

-

Answer: While Summerville has excellent schools across the area, the general consensus is that properties zoned for Dorchester District Two (DD2) consistently maintain the highest resale value. DD2 is widely regarded for its exceptional academic performance and desired reputation, making homes in this zone attractive to a broader pool of buyers, ensuring strong demand when it’s time to sell.

3. What is the average timeline from making an offer to getting the keys?

-

Question: Once our offer is accepted, how long does the entire closing process typically take for a first-time homebuyer using a loan?

-

Answer: The average timeline from an accepted offer to closing day is typically 30 to 45 days. This allows enough time for the critical steps: a 7-10 day due diligence period for the home inspection, approximately 2-3 weeks for the bank appraisal, and the final week for the lender to complete the loan underwriting and clear the file for closing.

4. Can we buy a home in Summerville if we have student loan debt?

-

Question: We have significant student loan debt; will this prevent us from qualifying for a mortgage to buy our first home in Summerville?

-

Answer: Student loan debt will not automatically disqualify you, but lenders will carefully analyze your Debt-to-Income (DTI) ratio. As long as your total monthly debt payments (including the projected mortgage) do not exceed the lender's limit (often around 43-50% of your gross income), you can qualify. We recommend connecting with a specialized mortgage lender who knows how to best calculate the DTI for various student loan repayment plans.

5. What is Private Mortgage Insurance (PMI), and how can we avoid or remove it?

-

Question: We want to put less than 20% down; what exactly is Private Mortgage Insurance (PMI), and is there any way to eventually get rid of it?

-

Answer: PMI is a monthly premium charged by the lender when your down payment is less than 20%, protecting them if you default on the loan. It is typically added to your monthly mortgage payment. You can often get rid of PMI once your loan balance reaches 80% of the home's original appraised value, which is achieved through years of payments or by requesting a home reappraisal once you have built up sufficient equity.

Categories

- All Blogs (83)

- Cost of Living in Summerville SC (21)

- Cost of Selling or Buying a Home (23)

- Downtown Summerville SC (6)

- Freebie (2)

- Golf in Summerville SC (2)

- Guides (15)

- Job Opportunities in Summerville SC (1)

- Lifestyle and Culture (22)

- Market Trends (3)

- Nearby Areas & Comparison Guides (15)

- Neighborhoods in Summerville SC (21)

- PCSing to Charleston - Military Guidance (12)

- PCSing to Charleston SC (22)

- Property Taxes in Summerville SC (6)

- Relocation Questions & Miscellaneous Topics (39)

- Retire in Summerville SC (5)

- Schools in Summerville SC (13)

- Things to do in Summerville SC (6)

Recent Posts