How Much Do I Need to Make to Afford a House in Summerville SC? Your Complete Income Guide for Lowcountry Living

How Much Do I Need to Make to Afford a House in Summerville, SC? Your Complete Income Guide for Lowcountry Living 🏡💰

Welcome to Summerville, South Carolina, the "Flower Town in the Pines"! We know you're dreaming of planting roots in this beautiful, thriving Lowcountry community. Whether you’re relocating for work, looking for better schools, or simply craving the charm of historic downtown, one of the first and biggest questions we hear is: "How much do we need to afford a house in Summerville, SC?"

As a local husband-and-wife real estate team, we've helped countless families navigate this exact question. We understand that figuring out the finances can be the most intimidating part of the home-buying process. Forget generic online advice, we're diving deep into the specifics of the Summerville market to give you a clear, actionable roadmap for your home purchase. From calculating your ideal home price to decoding your debt-to-income ratio (DTI), we’ll break down exactly what your household income needs to look like to confidently buy a home here.

We're going to use real, current Summerville housing data, explore typical monthly mortgage costs, and show you how lenders determine your buying power. By the end of this guide, you’ll have a clear financial goal, empowering you to move forward in your home search with confidence.

Understanding the Summerville Housing Market: What Are We Up Against?

Before we can calculate a target income, we first need to establish what a "typical" Summerville home costs. The price of a home directly dictates the size of the mortgage you’ll need, which in turn sets the minimum income requirement.

The Current Median Home Price in Summerville, SC

Summerville's popularity has driven significant growth in home values. Unlike in previous years, when prices were lower, the market today reflects the area's desirability.

As of late 2024 and heading into 2025, the median home price in Summerville, SC, is trending higher than what many might expect. Recent market forecasts anticipate that the median home price in Summerville could reach around $450,000 to $465,000 by the end of 2024 and early 2025. This figure represents a balanced, middle-of-the-road price point for a single-family home. Some market data even suggests a median closer to $600,000, depending on the specific neighborhood and data source, but to provide a conservative, actionable target for a comfortable family home, we will base our core calculations on a target price of $450,000.

It is important to remember that Summerville offers a diverse range of neighborhoods. Areas like Cane Bay Plantation or Wescott Plantation often have median prices in the $375,000 to $425,000 range, which is more accessible. Conversely, specific, sought-after areas or historic districts can easily push median prices well past the $600,000 mark. Your target income will shift dramatically based on which part of Summerville you choose.

The Role of Median Household Income

It's helpful to compare housing costs to what people in the area actually make. The most recent data (2023) shows the median household income in Summerville, SC is approximately $78,621. This means that half of all households in the town earn more than this amount, and half earn less.

-

If your household income is near the median of $78,621, you'll likely need to be strategic, focusing on homes at the lower end of the market and potentially utilizing low down-payment loan options like FHA or VA (if eligible).

-

To comfortably afford a $450,000 home with a standard conventional loan, we’ll need to target a significantly higher income level, as we'll detail in the next section.

The Golden Rule: Debt-to-Income (DTI) Ratio and Your Home Buying Power

Lenders don't just look at your annual income; they focus on your Debt-to-Income Ratio (DTI). This is the single most important factor determining how much a bank will lend you. Our main goal for you is to ensure your DTI is in a healthy range to secure the best loan terms.

Decoding the DTI Ratio

The DTI ratio is the percentage of your gross monthly income (income before taxes) that goes toward debt payments. Lenders use two main numbers:

-

Front-End Ratio (Housing Ratio): This is the total monthly housing payment (Principal, Interest, Taxes, Insurance, and HOA dues) divided by your gross monthly income. For a conventional loan, lenders prefer this number to be no higher than 28%.

-

Back-End Ratio (Total Debt Ratio): This includes your total monthly housing payment PLUS all other monthly debt payments (car loans, student loans, minimum credit card payments) divided by your gross monthly income. For a conventional loan, this is typically capped at 36%, although some programs may allow up to 43% or even higher for highly qualified borrowers.

To be safe and ensure you qualify for the best rates, we will aim for a DTI of 28/36 or better.

Calculating the Monthly Payment for a $450,000 Summerville Home

To work backward and find the required income, we first need a realistic estimate of the total monthly housing payment for a $450,000 home.

Assumptions for our calculation:

-

Home Price: $450,000

-

Down Payment: 5% (Conventional) = $22,500

-

Loan Amount (Principal): $450,000 - $22,500 = $427,500

-

Interest Rate (P&I): We'll use a conservative 7.0% APR on a 30-year fixed loan for today's market, which is a common rate depending on your credit profile.

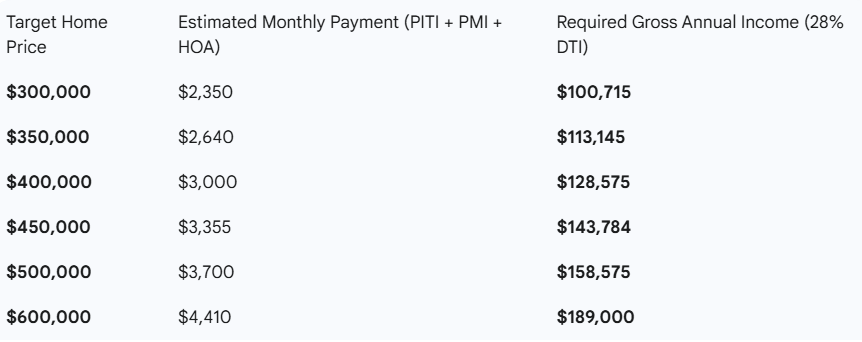

A Quick Look at Income Required for Different Price Points

To help you quickly gauge where your household stands, here is a breakdown of the estimated annual gross income required for different price points in the Summerville market, assuming a 5% down payment and standard debt levels (the calculations follow the same methodology as above and may be slightly higher or lower based on specific insurance, taxes, and HOA fees).

This table clearly illustrates that you can comfortably afford the median-priced home in Summerville with an income around the $144,000 mark. However, if your household is making a solid $110,000 per year, we can absolutely find you a wonderful home in the $350,000 range and lower.

Planning and Preparation: Our 5-Step Path to Summerville Homeownership

Affordability isn’t just a number; it’s a strategic process. As your dedicated real estate partners, we recommend following these five steps to ensure your income aligns with your homeownership goals.

Step 1: Calculate Your True Gross Monthly Income

Gather all income sources: Salary, hourly wages, commissions, bonuses (lenders typically require a two-year average for variable income), and any verifiable secondary income. Remember, we use the gross amount (before taxes) for all DTI calculations. This is the foundation of your purchasing power. Don’t estimate; use pay stubs and tax documents to find your precise monthly gross income.

Step 2: Tally Your Total Monthly Debt Payments

List every monthly payment that will appear on your credit report:

-

Minimum credit card payments

-

Car loan payments

-

Student loan payments (even if deferred, lenders will use a calculated payment)

-

Personal loan payments

-

Alimony or child support obligations

This total represents your non-housing monthly debt.

Step 3: Speak to a Local Summerville Lender

This is the most critical step. A quick, accurate pre-approval process is the only way to know your true buying power. A local mortgage professional will factor in the specific Summerville property tax rates and insurance costs, giving you a precise maximum monthly payment. We work closely with several trusted local lenders who specialize in Lowcountry properties and can often secure better rates and terms than national online banks.

Step 4: Determine Your Comfortable Price Point

Just because a lender approves you for a certain loan amount doesn't mean you should spend that much. We always encourage our clients to review their post-closing budget. Consider your take-home pay, your desired lifestyle, and savings goals. We want you to be house-rich, not house-poor. Let’s find the intersection of what the bank approves and what makes you feel financially secure.

Step 5: Partner with Us, Your Summerville Real Estate Experts

Once you have a pre-approval in hand, that number is your target. We then go to work, hyper-focusing our search to properties that fit not only your spatial needs but your precise financial requirements. From negotiating a great price to ensuring you get the best deal, we are with you every step of the way.

The Summerville, SC, market is fast-paced and competitive. Having an experienced team in your corner that understands the nuances of local affordability is key to turning your income calculation into a set of keys.

Are you ready to stop dreaming and start doing? Calculating your required income is just the first step on your journey to homeownership in Summerville, SC. Our team is here to help you turn these numbers into a successful home search strategy.

Don't wait to figure out your finances! Contact us today for a personalized consultation. We’ll connect you with our top local mortgage partners to get a detailed pre-approval tailored to the Summerville market.

Frequently Asked Questions

1. What is the typical down payment needed for a Summerville home?

While 20% down is ideal to avoid Private Mortgage Insurance (PMI), most buyers in Summerville, SC, use significantly less. Conventional loans often require as little as 3-5% down, and FHA loans require 3.5%, making homeownership more accessible. We regularly help buyers utilize low-down-payment options, particularly for first-time buyers, veterans, or those using specific local assistance programs. The size of your down payment directly impacts your monthly payment and, therefore, your required income, so we strategically plan this amount with you.

2. Are property taxes high in Summerville, SC?

South Carolina generally has one of the lowest property tax rates in the nation for owner-occupied primary residences. Property taxes in Summerville are considered low compared to many other states, especially in the North and West. For a primary residence, the tax assessment ratio is only 4%, keeping annual costs manageable and boosting your overall affordability. We always confirm the exact millage rate based on the specific county and municipality of the property you are considering.

3. How long does the home buying process usually take in Summerville?

From the moment we start looking at homes to the day you get the keys, the process typically takes about 60 to 90 days in the Summerville market. The most time-consuming steps are securing the initial pre-approval and the 30- to 45-day mortgage underwriting and closing period once an offer is accepted. We work to streamline this process by preparing you in advance and moving quickly in the competitive Summerville market.

4. Is it better to pay off debt or save for a larger down payment?

The best strategy depends on which is currently limiting your pre-approval amount—your Debt-to-Income (DTI) ratio or your available cash for the down payment. If your DTI is over 36%, paying off high-interest debt like credit cards is usually the priority to improve your borrowing eligibility. If your DTI is fine but you can't afford a 5% down payment, saving cash is the answer, though you should explore loan options with lower minimum down requirements. We always run the numbers both ways to determine the most financially sound path for your situation.

5. What closing costs should we expect when buying a Summerville home?

Buyers should typically budget an additional 2% to 5% of the purchase price for closing costs in Summerville. These costs cover items like lender fees, title insurance, appraisal fees, attorney fees, and prepaid items like initial property taxes and homeowners insurance premiums. For a $450,000 home, this could range from $9,000 to $22,500, in addition to your down payment. We provide a detailed estimate of these costs upfront so there are no surprises at the closing table.

Deep Dive into Affordability Factors: Why Summerville, SC is Worth the Investment

The question of "how much income" is intrinsically tied to the value and quality of life in Summerville. We’ve established the mathematical benchmarks, but it’s just as important to understand why these numbers reflect a smart, long-term investment. Summerville isn’t just a place to live; it's a rapidly appreciating asset driven by strong local economies and unparalleled community features.

Economic Drivers Fueling Home Value

Summerville’s strategic location near the major employers in the Charleston Tri-County area is a significant factor in its sustained housing demand. We see continuous employment growth from large industries and corporations, including major automotive and aerospace manufacturers. This robust and diversified economic base ensures that the job market remains strong, supporting local incomes and keeping housing inventory desirable. When an area has a healthy, growing economy, it provides a layer of security to your home investment, which is why the income requirements here reflect a desirable and competitive market.

The Cost of Home Insurance in the Lowcountry

While we've included an estimate for homeowners insurance in our monthly payment calculation, it's worth noting the regional factor. As a coastal adjacent area, Summerville's insurance costs can be slightly higher than inland communities. Lenders are keenly aware of this and require adequate coverage for wind, hail, and sometimes flood insurance (depending on the property's location). This mandatory monthly expense directly contributes to your total housing payment (PITI), further reinforcing the need to meet our calculated income benchmark.

-

Tip: When you are pre-qualifying, we work with insurance brokers who can provide you with accurate, tailored quotes for the specific property you are considering. This helps lock down the T and I in your PITI calculation early in the process.

The Power of the Median Household Income in Negotiations

Our earlier discussion established the Summerville median household income at approximately $78,621. While you need nearly double that for a standard conventional loan on a $450,000 home, understanding this local median is key to the overall health of the market. The high demand is fueled by a mix of local income and an influx of higher-earning transplants attracted by the robust job market and the quality of life. This consistent demand, even above the median income, contributes to bidding wars and quick sales, which is why a strong pre-approval, backed by the necessary income, gives us a competitive edge when negotiating on your behalf.

-

Our competitive advantage: Having a strong income profile means we can present a clean, attractive offer with a robust pre-approval letter, making your offer stand out in multi-offer situations.

Top 5 Questions for Buying or Selling a Home in Summerville, SC (Part 2)

1. Will I qualify for a lower required income if I have an excellent credit score?

Yes, an excellent credit score, typically 740 or higher, can positively impact your required income by securing a lower interest rate. A lower interest rate directly reduces the Principal and Interest portion of your monthly payment (P&I). This reduced monthly payment, in turn, requires a lower gross annual income to satisfy the lender's Debt-to-Income (DTI) requirements. Lenders view a high score as an indicator of low risk, often giving us more flexibility in DTI or access to better loan products. We prioritize improving credit scores before applying to maximize your purchasing power in Summerville.

2. Can gift money be used for the down payment to lower my income requirement?

Absolutely, gift funds from a family member are a common and accepted source for your down payment and closing costs, which significantly lowers your required savings. Using a larger down payment from a gift allows us to choose a smaller loan, thereby reducing your monthly Principal and Interest (P&I) payment. A smaller P&I payment directly lowers your overall housing debt, which brings down the income required to meet the DTI ratio. We ensure all gift funds follow lender guidelines, including a signed gift letter and proof of fund transfer, to keep your transaction smooth.

3. What is the impact of a high HOA fee on my required income?

A high Homeowners Association (HOA) fee directly increases your total monthly housing payment, which negatively impacts your affordability and raises your required income. The monthly HOA fee is included in the front-end Debt-to-Income (DTI) ratio, just like taxes and insurance. If a Summerville neighborhood has a $300 monthly HOA fee instead of our estimated $50, the $250 difference means you need roughly an extra $10,700 in annual income to maintain the 28% DTI. We carefully factor in all HOA and PUD (Planned Unit Development) fees when setting your search criteria to avoid exceeding your qualified income.

4. How does being self-employed affect the income required to buy a house in Summerville?

If you are self-employed, lenders will typically require a two-year history of tax returns to calculate your average qualifying income, and they focus on your net income after deductions. Since business owners often take many deductions to lower their taxable income, the income that qualifies for the mortgage may be significantly lower than the gross revenue. This means a self-employed buyer may need a much higher gross income (before deductions) to meet the same DTI requirements as a W-2 employee. We partner with specialized lenders who know how to analyze self-employment income to maximize your approved loan amount.

5. If we sell our current house, how does that money affect our required income for a new Summerville home?

The proceeds from the sale of your current home provide a significant cash injection that will be used for a large down payment on your new Summerville home, dramatically reducing your loan size and, consequently, your required income. A larger down payment can eliminate Private Mortgage Insurance (PMI) and substantially lower your Principal and Interest (P&I) payment. Furthermore, selling your current home removes that mortgage debt from your back-end DTI calculation, which immediately increases the amount of new debt (the new Summerville mortgage) you can afford, potentially allowing you to purchase a more expensive home. We coordinate our transactions to manage the timing of the sale and purchase seamlessly, often using bridge loans or contingent offers.

Categories

- All Blogs (83)

- Cost of Living in Summerville SC (21)

- Cost of Selling or Buying a Home (23)

- Downtown Summerville SC (6)

- Freebie (2)

- Golf in Summerville SC (2)

- Guides (15)

- Job Opportunities in Summerville SC (1)

- Lifestyle and Culture (22)

- Market Trends (3)

- Nearby Areas & Comparison Guides (15)

- Neighborhoods in Summerville SC (21)

- PCSing to Charleston - Military Guidance (12)

- PCSing to Charleston SC (22)

- Property Taxes in Summerville SC (6)

- Relocation Questions & Miscellaneous Topics (39)

- Retire in Summerville SC (5)

- Schools in Summerville SC (13)

- Things to do in Summerville SC (6)

Recent Posts